|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding RN Mortgage Loans: A Comprehensive GuideWhat are RN Mortgage Loans?RN mortgage loans are specialized home loan products tailored for registered nurses (RNs). These loans are designed to offer favorable terms and conditions, acknowledging the unique financial circumstances and stability associated with the nursing profession. Benefits of RN Mortgage LoansLower Interest RatesOne of the significant benefits of RN mortgage loans is the potential for lower interest rates. This can translate into substantial savings over the life of the loan. Flexible Down Payment OptionsThese loans often come with flexible down payment options, making it easier for nurses to enter the housing market without needing a substantial upfront payment. Streamlined Approval ProcessThe approval process for RN mortgage loans is typically streamlined, recognizing the steady income and reliable employment status of registered nurses. How to Qualify for RN Mortgage LoansQualifying for an RN mortgage loan involves several key steps:

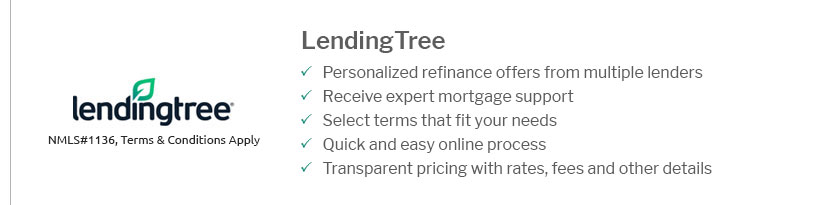

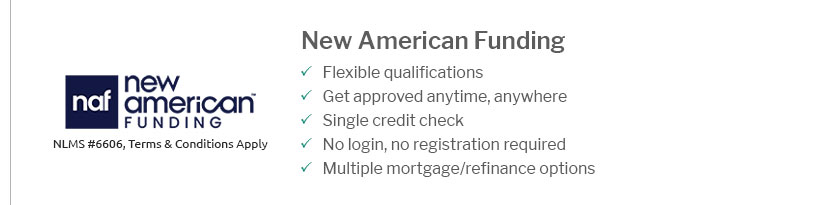

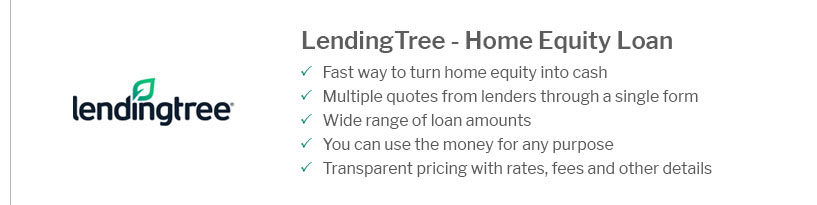

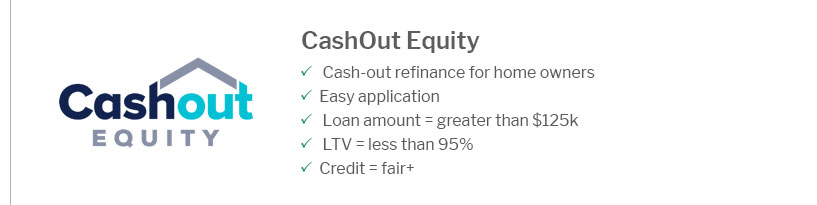

It's essential to review current refinance rates as part of the qualification process, as they can impact the loan's affordability. Choosing the Right LenderSelecting the right lender is crucial for securing the best terms. Research potential lenders and compare their offerings.

For those who have previously engaged with trust deeds, finding mortgage lenders after trust deed can be particularly beneficial. Frequently Asked QuestionsWhat credit score is needed for RN mortgage loans?While requirements can vary, a credit score of 620 or higher is generally preferred. However, some lenders might offer flexibility for registered nurses. Can student loans affect my eligibility?Yes, student loans are considered in your debt-to-income ratio. However, lenders may offer guidance on managing student debt to improve eligibility. Are there additional fees associated with these loans?Fees vary by lender, but it's important to ask about origination fees, closing costs, and any other charges upfront. ConclusionRN mortgage loans provide a valuable opportunity for registered nurses to secure home financing under favorable conditions. By understanding the benefits, qualifications, and choosing the right lender, nurses can effectively navigate the home buying process and achieve their homeownership goals. https://themortgagereports.com/80399/home-loans-for-nurses-programs-grants

We recommend six mortgage programs in totaltwo are specialized home loans for nurses, while the other four are standard loan programs open to ... https://www.homesforheroes.com/blog/registered-nurse-mortgage-program/

Registered nurses can have a down payment as low as 3% of the purchase price. Disadvantages of a Conventional Loan: Generally requires a credit ... https://homebuyer.com/learn/home-loans-for-nurses

Fannie Mae and Freddie Mac backs conventional loans and allow for down payments as low as 3 percent. Conventional loans are often the default ...

|

|---|